"We view Varonis as a textbook case where 'more is more,'" writes Needham analyst Alex Henderson (Buy), "meaning new customers are buying more of the platform upfront, and then expanding their deployments more rapidly - demonstrating improved customer lifetime economics and the fruits of a more consumable platform."

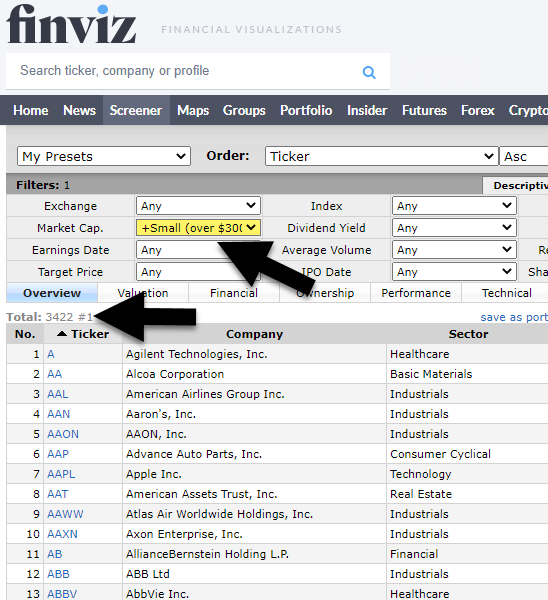

#Micro cap stocks with 1 billion revenue software

But it's the company's transition away from selling software licenses to offering cloud-based subscriptions that makes the Street salivate over its prospects. Varonis Systems ( VRNS, $46.36), a data security and analytics software firm, protects unstructured data not stored in a database - an increasingly tasty target for hackers. Analysts' consensus recommendation: 1.60 (Buy).That's one of the biggest expected returns among our 12 best small-cap stocks for 2022. Their average price target of $70.55 gives GBT implied upside of about 141% in 2022. Of the 22 analysts covering the biotech tracked by S&P Global Market Intelligence, 13 rate it at Strong Buy, four say Buy and five call it a Hold. Optimism abounds on the Street, which gives GBT stock a consensus recommendation of Buy, with high conviction. "We rate GBT Outperform based on our assessment of the commercial potential of Oxbryta in sickle cell disease," writes Oppenheimer analyst Mark Breidenbach in a note to clients.Ĭatalysts for GBT stock include the potential for regulatory approval of Oxbryta in Europe in the first half of 2022, the analyst adds, as well as the firm's pipeline - notably its next-generation sickle hemoglobin polymerization inhibitor. Analysts see the pediatric label expansion as critical to driving broader uptake of the medication. Oxbryta, the company's oral, once-daily treatment for sickle cell disease (SCD), was granted regulatory approval for use in patients as young as four years old in mid-December. The biopharmaceutical company specializing in treatments for rare blood diseases has a potential hit on its hands and a promising development pipeline, bulls say. Analysts' consensus recommendation: 1.64 (Buy)Īnalysts see tremendous upside in shares of Global Blood Therapeutics ( GBT, $29.33) in 2022.The bottom line? Read on to see Wall Street's 12 favorite small-cap stocks to buy now as 2022 kicks into gear. Lastly, we dug into research, fundamental factors, analysts' estimates and other data on the top-scoring names. We then limited ourselves to names with at least 10 Strong Buy recommendations. The closer the score gets to 1.0, the stronger the Buy call. Any score of 2.5 or lower means that analysts, on average, rate the stock a Buy. Here's how the process works: S&P Global Market Intelligence surveys analysts' stock ratings and scores them on a five-point scale, where 1.0 equals Strong Buy and 5.0 means Strong Sell. To that end, we screened the Russell 2000 for analysts' top-rated small-cap stocks. With small caps teed up for a better 2022, we turned to Wall Street analysts to find the best small-cap stocks to buy for the new year. Importantly, in addition to being "the least-expensive asset class," adds Hall, small caps offer a greater degree of diversification than stocks with larger market values. "Valuations today imply high-single-digit annualized returns for small caps over the next 10 years." "While large and mid caps trade at a 35% to 40% premium to history, small caps now trade in-line with history," writes Jill Carey Hall, equity and quant strategist at BofA Securities. On the bright side, a year of underperformance has small-cap stocks priced to outperform in 2022 and beyond, the pros say.

The usual suspects of COVID-19 uncertainty, supply-chain snafus, inflationary pressures and expectations of interest-rate hikes were particularly hard on small caps. Small-cap stocks – or stocks with market values of roughly less than $2 billion – are supposed to outperform in an economic recovery, so it's understandable if investors in this class are a bit more than disappointed.

0 kommentar(er)

0 kommentar(er)